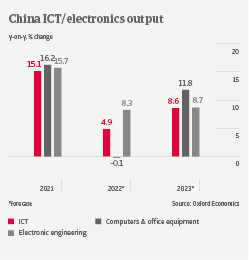

After a 15% increase in 2021, we expect Chinese ICT output growth to slow down in 2022 and 2023, but to remain solid. Production of electronic components and boards are the main growth driver, and chip manufacturers have started to ramp up production to overcome supply shortages. Nevertheless, we expect that chip supply bottlenecks will persist into 2023. This affects ICT production and sales, particularly in the PC, laptop, smartphones, and consumer electronics segments. Another issue has been the lockdowns in several regions and large cities like Shenzhen and Shanghai. These have been partially lifted, but another wave of the pandemic with subsequent new restrictions remains a downside risk for local sales as well as domestic and international supply chains.

During the coming years, increasing internet penetration and high-speed internet will sustain demand for related IT-infrastructure and services. Rising disposable incomes will continue to drive domestic demand for consumer-related ICT products.

Restrictions imposed by the US aimed at blocking or limiting the delivery of high-tech goods to China (in particular semiconductors and chip-making equipment) will spur ICT investment. Digital transformation is a core economic target mentioned in the 14th Five-Year Plan (2021-2025). The mid and long-term target is to boost China's global competitiveness in advanced technologies such as semiconductors and artificial intelligence. In January 2022, the State Council published a blueprint for the future development of the digital economy. It aims to increase the contribution of core digital industries to 10% of GDP by 2025. The government has set a target to produce 70% of semiconductors domestically by 2025.

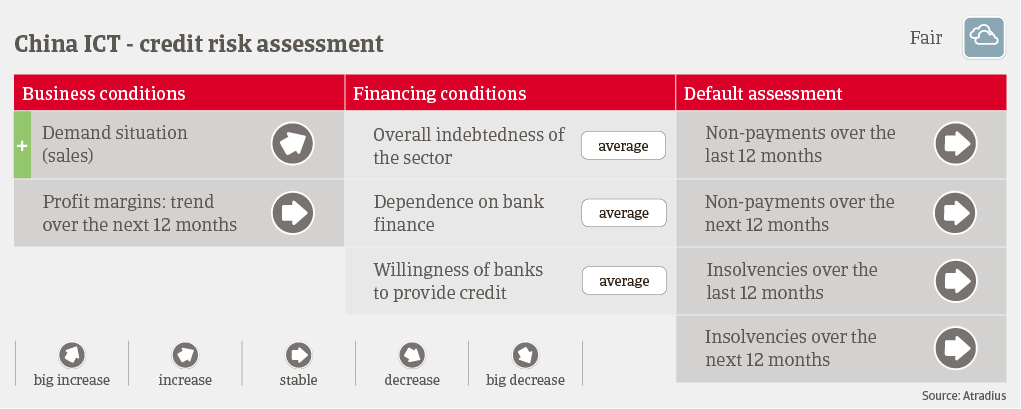

We expect that profit margins of Chinese ICT businesses will remain stable in the coming twelve months, because in most cases both producers and retailers are able to pass on increased input prices for chips to end-customers. Additionally, many companies have reduced other expenses. Payment terms in the Chinese ICT industry take 60 days on average, and the amount of non-payment cases is low. When payment delays occur, the reasons are mainly administrative issues or disputes about product quality. We expect no substantial increase in payment delays and insolvencies in the coming twelve months.

Our underwriting stance is open for the IT production and telecommunication subsectors, as both mainly consist of state-owned businesses. However, we are restrictive for electronic component producers, because local chip producers currently face financial strains due to sizable investment in R&D. Most high-end chips are produced by foreign companies and remain irreplaceable for the time being. We are neutral for ICT wholesalers and retailers. These are mainly private-owned and susceptible to higher external financing costs, due to thin margins.